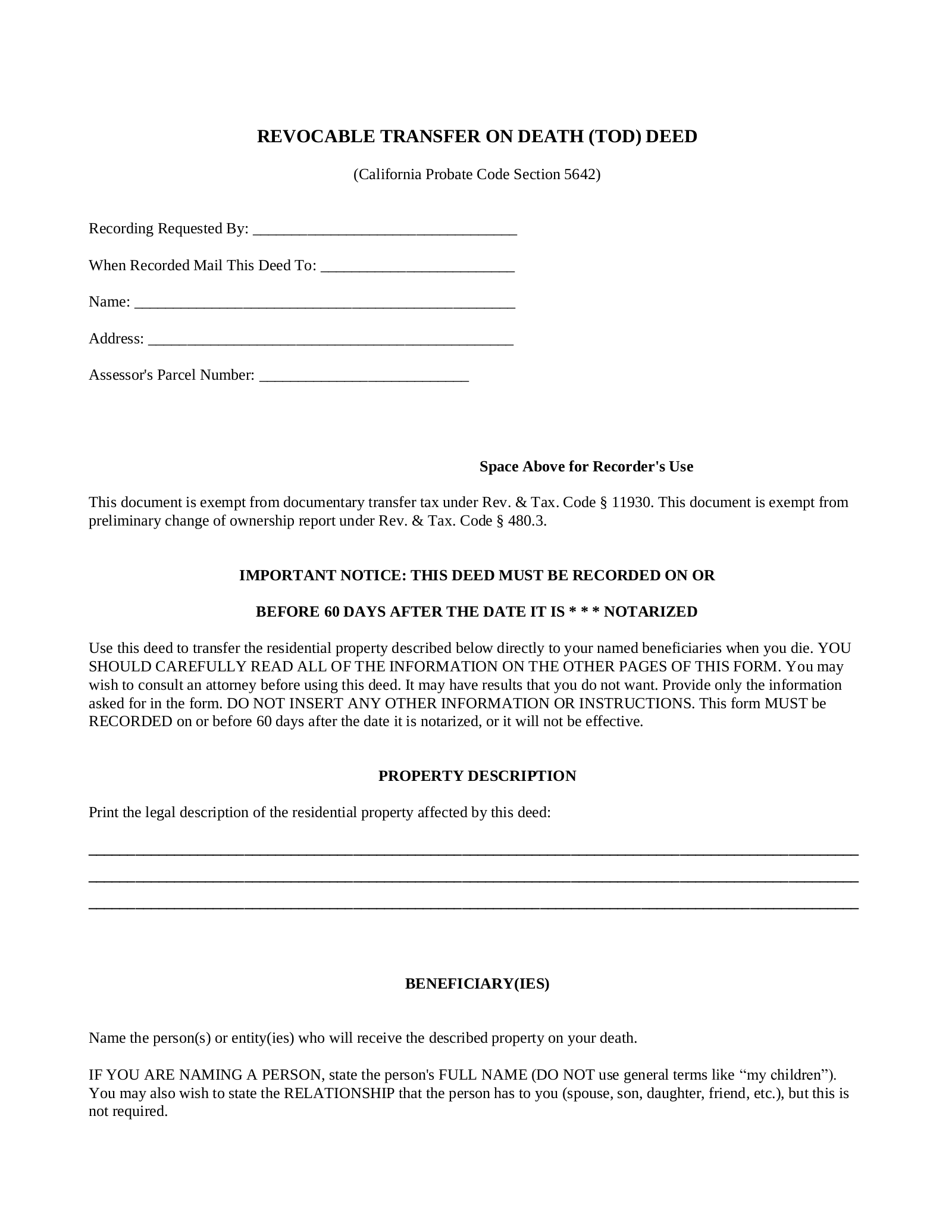

Not good.Įqually disagreeable is the two-year gotcha, which is the incredibly long time that unpaid creditors have after death of the owner to drag the property back into the probate estate and force its sale. If the beneficiary can’t make the mortgage payment or pay off the other liens, then that could lead to a foreclosure of the property, leaving beneficiaries with bad credit and no inheritance. That has led to more problems, because beneficiaries of the TOD deed take the property with all of its warts, including all tax liens, mortgages, judgment liens and liens created by the deceased owner’s divorce obligation to a former spouse. As a result, many beneficiaries who have received property under a TOD deed have been unable to sell or refinance it for the first two years. A Transfer on Death Deed transfers the property to the beneficiary subject to any existing legal encumbrances, conveyances, assignments, contracts, mortgages.

Most are refusing to even write title insurance for the transferred property for the two-year period following the owner’s death. To ensure you are making the best decision for your family, take the time to sit down with an experienced and knowledgeable trust & estate planning attorney who is familiar with California law.Another big problem: Title companies don’t like TOD deeds. Talk to an Experienced Trust & Estate Planning Attorney in CaliforniaĪs you can see, there are many factors to weigh when deciding whether it makes sense to create a revocable transfer on death deed. In some states, residents have the option to sign and record a transfer on death deed (sometimes abbreviated to TOD deed, or just TODD). Another issue that your real property may still be subject to Medi-Cal estate recovery if you were a recipient of Medi-Cal benefits. Instead, a court-appointed custodian will be granted control and management of the property until your beneficiary reaches legal age.

Yet another disadvantage is the fact that if you leave your property to a beneficiary who is still a minor when you pass on, the beneficiary will not automatically receive your property.

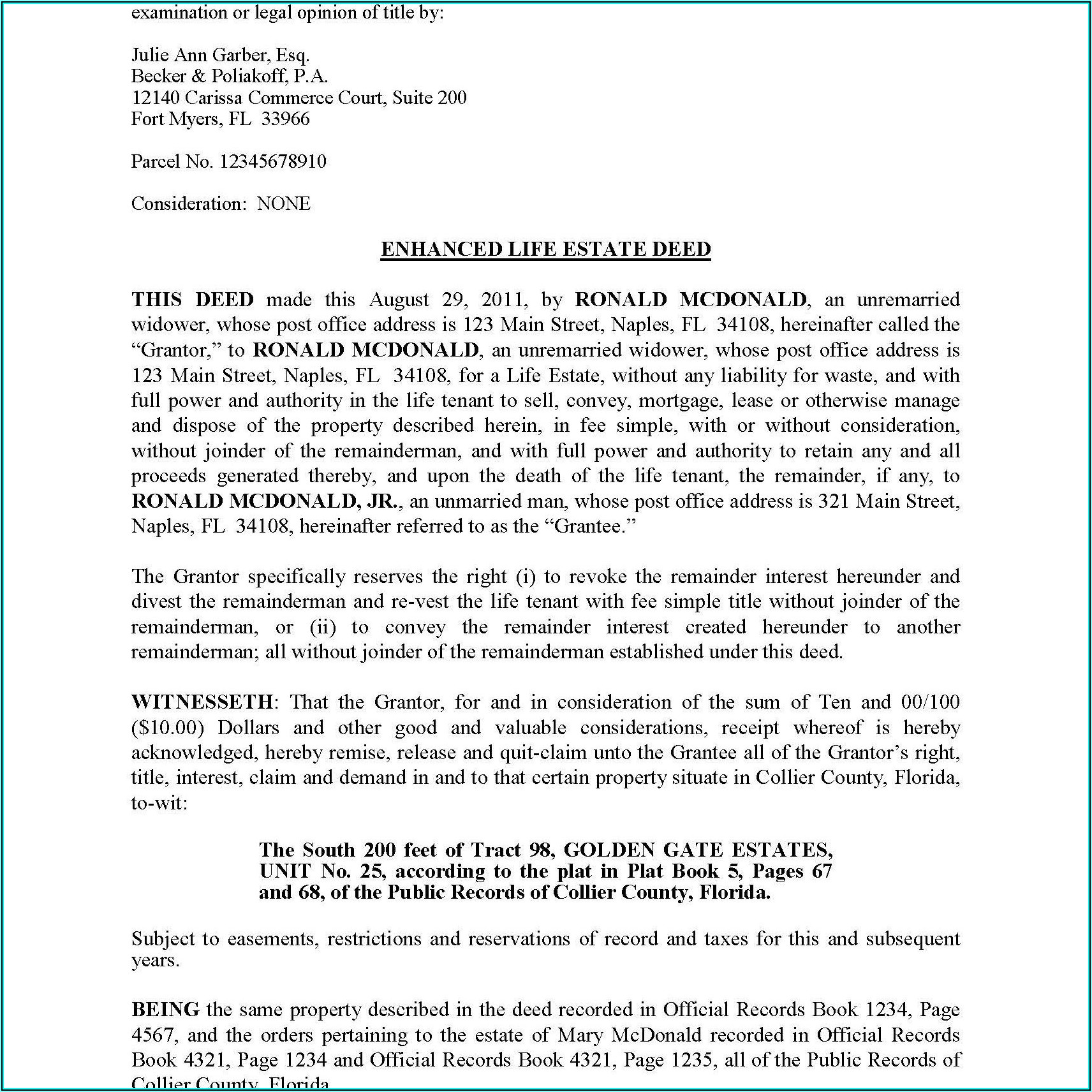

Dtransfer on death deed co benficiaries full#

In this situation, your joint tenant becomes the sole owner of the property upon your passing and has full control of the property, even if you created a transfer on death deed. Another disadvantage is if you co-own property under a joint tenancy. For example, your property will be subject to probate court if your beneficiary predeceases you and you lack an alternate estate plan. Disadvantages of a Transfer on Death Deedĭespite the many advantages associated with a revocable transfer on death deed, there are some disadvantages to consider. Transfer on death deeds, legal in Texas since 2015, have been heralded as the latest, greatest method for keeping real property out of probate. Another advantage is, as the name implies, the deed is fully revocable during your life time so you can maintain control and ensure the property is passed on to the beneficiary of your choosing. This deed will protect your property from probate court, as long as your chosen beneficiary does not predecease you. For example, the filing and recording of the transfer on death deed is fairly cost effective and straightforward. There are many advantages associated with a revocable transfer on death deed. For example, the only forms of real property that qualify for a transfer through this deed are (i) a single-family home or condo unit, (ii) a single-family residence that sits on agricultural property of 40 acres or less, or (iii) the residence has no more than four residential dwelling units. There are some limitations associated with transferring real property through this type of deed. Limitations to a Revocable Transfer on Death Deed As used in this article: Beneficiary means a person that receives property under a transfer on death deed. This alternative is known as a “revocable transfer on death deed.” This type of deed is sometimes referred to as the “poor man’s trust.” Why? Because it is a less costly way to transfer real property to a named beneficiary without having to create a full-fledged trust. The California legislature enacted a law in 2016 that offered residents an alternative to keep their homes out of the costly and inefficient probate process.

0 kommentar(er)

0 kommentar(er)